It is also essential to handle repayments effectively. Failure to do so may result in extra substantial debts as a outcome of accruing curiosity and potential penalties.

It is also essential to handle repayments effectively. Failure to do so may result in extra substantial debts as a outcome of accruing curiosity and potential penalties. Prospective debtors should carefully think about their monetary state of affairs and solely borrow what they can afford to repay comforta

Moreover, secured loans require collateral—such as a home or vehicle—that the lender can claim if the borrower defaults. While these loans typically come with lower interest rates, they do carry the danger of shedding useful assets, making cautious consideration import

If you finish up unable to meet

Loan for Defaulters payments, it is important to communicate together with your HR division or lender as soon as attainable. They might provide options similar to a repayment plan, deferments, or refinancing. Ignoring the state of affairs can result in more important monetary points and harm to your credit rat

Moreover, debtors must present verification paperwork such as proof of earnings, financial institution statements, and identification. These documents can often be submitted electronically, dashing up the approval process. It is crucial to have all needed documentation ready when making use of for a no-visit loan to avoid any del

The website allows customers to match totally different loan merchandise and lenders facet by aspect. This transparency ensures that individuals can make informed decisions based on their monetary wants. With BePick's insightful critiques and analysis, borrowers can find one of the best further mortgage choices out there in the mar

Once documentation is prepared, the next step is to choose the right lender. Depending on the kind of mortgage, choices could embody banks, credit unions, or different lenders. Each lender may have different terms, interest rates, and requireme

Understanding Repayment Terms

Repayment terms for worker loans can range widely based mostly on the specific lender or employer program. Generally, repayment occurs by way of payroll deductions, which may simplify the process and ensure timely payments. Employees should have a clear understanding of how much might be deducted from their paychecks and for the way long these repayments will conti

Finally, submitting a loan software entails filling out types rigorously and offering the required documentation. The lender will evaluation the appliance, and if accredited, you will obtain the mortgage agreement outlining terms, interest rates, and repayment schedu

By leveraging Be픽, employees can achieve data about interest rates, compensation plans, and eligibility standards, permitting them to compare multiple choices available available in the market. This knowledgeable strategy finally leads to better monetary choices and helps workers keep away from pitfalls generally related to borrow

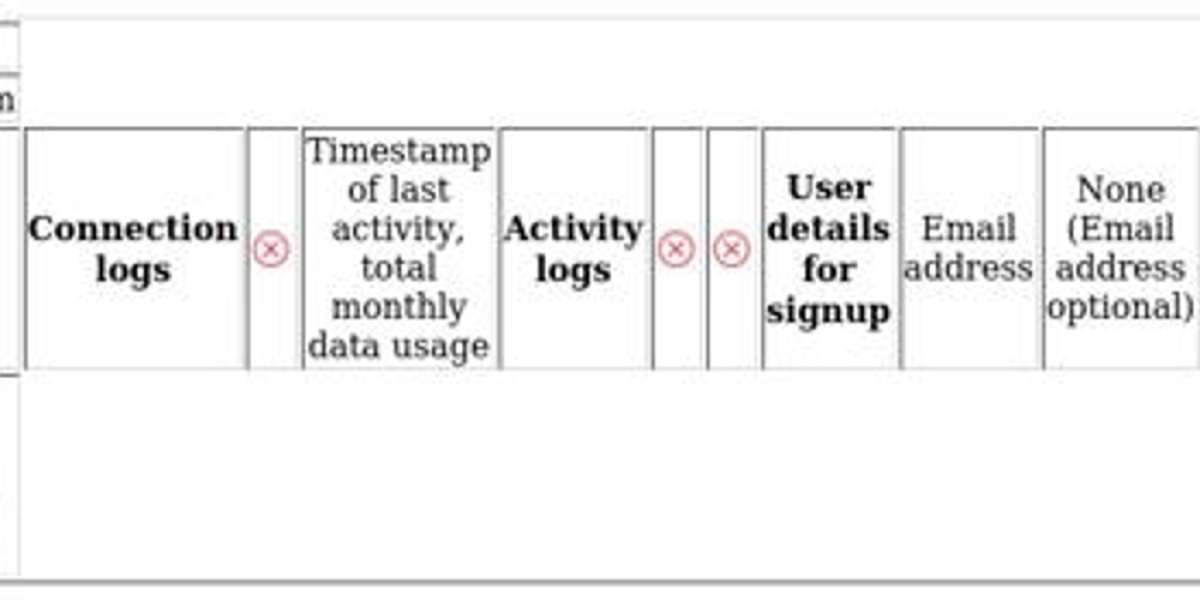

Understanding No-Visit Loans No-visit loans are personal loans that may be processed totally online. Unlike typical loans that may require the borrower to go to a bank or lending institution, no-visit loans permit for a seamless expertise from application to disbursement. This digital method utilizes know-how to streamline processes, enabling quicker approvals and funding. Potential debtors fill out applications online, submit essential documentation through secure channels, and sometimes obtain funds on the identical

Same Day Loan or within a couple of enterprise days. Such loans are ideal for those with busy schedules or those that choose the comfort of digital transactions with out the trouble of physical meeti

Many people use these loans to manage unexpected bills, similar to medical payments or emergency repairs. In such cases, having access to quick financing can alleviate stress and provide peace of mind. Knowing when and how to leverage credit loans can considerably impact your financial well-be

The Role of Be픽 in Employee

Non-Visit Loan Research

Be픽 is a dedicated on-line platform that provides comprehensive information and assets on employee loans. It serves as a valuable device for people seeking to understand their choices and make informed decisions. The web site options detailed evaluations, comparisons of varied mortgage products, and insights into the phrases and conditions associated with different lo

How BePick Helps You Find No-Visit Loans

BePick is a dedicated platform providing in-depth info and evaluations on no-visit loans. As borrowers navigate the usually complicated world of online lending, BePick acts as a dependable useful resource, showcasing various lenders and their offerings. The web site options comprehensive breakdowns of rates of interest, mortgage phrases, and customer service scores, empowering users to make knowledgeable choi

Considerations Before Taking a Credit Loan

Before securing a credit mortgage, it's critical to evaluate your financial state of affairs and understand your ability to repay. Lenders consider potential debtors on various elements, together with credit score historical past, income, and present debts. A thorough assessment of those elements might help keep away from potential pitfa

Exploring the Perfect Scam Verification Platform: Casino79 and the Essential Role of Toto Sites

Купить аттестат за 9 класс.

Купить аттестат за 9 класс.

Discovering the Perfect Scam Verification Platform for Sports Toto Sites – Toto79.in

Discovering the Perfect Scam Verification Platform for Sports Toto Sites – Toto79.in

Купить свидетельство о рождении.

Купить свидетельство о рождении.

Unlocking the Truth: Evolution Casino and the Onca888 Scam Verification Community

Unlocking the Truth: Evolution Casino and the Onca888 Scam Verification Community